Motorcycle Insurance 101

March 2, 2022

Insurance for Nonprofits & Social Services

May 25, 2022Collateral Assignment of Life Insurance

You may know that collateral is when you pledge an asset (like a car or home) to borrow money and in turn, gives the lender the right to sell the asset if you default on the loan. Because this reduces a lenders risk of losing money, it can lead to approval of larger loans and even reduce your interest rates.

Why is your favorite independent insurance agency talking about collateral? Sometimes, you can use your life insurance policy as this valuable asset, known as Collateral Assignment of Life Insurance.

What is Collateral Assignment of Life Insurance?

To appreciate Collateral Assignment, you first must have a sturdy understanding of Life Insurance (don’t worry, we’ve got a blog on that too). If you need to brush-up on Life Insurance basics, start here.

A Collateral Assignment essentially gives the lender a security interest in your life insurance policy to secure a loan. The ownership and the beneficiary of the policy are still established by the individual. Once the loan is paid, the collateral assignment is void, and in no event does the lender receive more than the balance of the loan. If you fail to pay on the loan, you give the lender rights to collect from the policy. Typically, lenders can collect in two scenarios:

Upon Death Using Death Benefit: If you die with unpaid dues, the lender can collect from your death benefit until your payments are reconciled.

Upon Default Using Cash Value: If you are living, but stop making payments, the lender can collect from the “surrender value.” This is the value of your policy upon cancellation. Once this is done, the contract is up and you submit your right to any future benefits under the policy, including your death benefit. This option is NOT always available, depending on the type of policy (don’t worry, we address this next).

How Does Collateral Assignment of Life Insurance Work?

There are various structures of Life Insurance policies, but most fit into one of these categories and will direct how lenders use it as collateral:

Permanent: One of the most attractive features to permanent policies is not only the “death benefit,” but also the “living benefit.” This is a tax-free savings account, known as “Cash Value,” the policyholder can use/borrow against during their lifetime. Lenders often prefer permanent policies because they can collect whether the policyholder is living or deceased. While living, the lender can cancel the policy and collect its cash value, and upon death, they can collect from the death benefit.

Term: This type of coverage provides financial protection for a specified length of time, known as a “term.” If the insured dies during an active term, beneficiaries will be paid. Because of the limited active timeframe, term policies do not offer “Cash Value.” This means the lender only has access to the death benefit if the policyholder dies while the policy is active. For this reason, term policies are typically used in conjunction with an SBA 7(a) loan (which often don’t have sufficient collateral to secure a conventional loan) to provide the bank a source of repayment if the key owner dies during the term of the loan.

What Happens to Your Beneficiaries?

Lenders are only permitted to collect what is owed to them. If your death benefit exceeds the amount due, lenders will take what is theirs and leave the remaining funds to your beneficiaries.

How Do You Start the Process?

First and foremost, you need a Life Insurance policy, followed by approval from your carrier. Transparency is always best. When notifying your advisor and carrier that you intend to offer your policy as collateral, there will be a formal process and collection of details to ensure all parties are on board. This is accomplished through a form signed by the insured and provided and acknowledged by the insurance company with the lender’s information listed.

Remember, Collateral Assignment of Life Insurance is complex, and we have only touched the surface. There may be alternative ways your life insurance policy can help you obtain a successful business loan. Lucky for you, we have an SBA expert on the team, who can provide support beyond the policy.

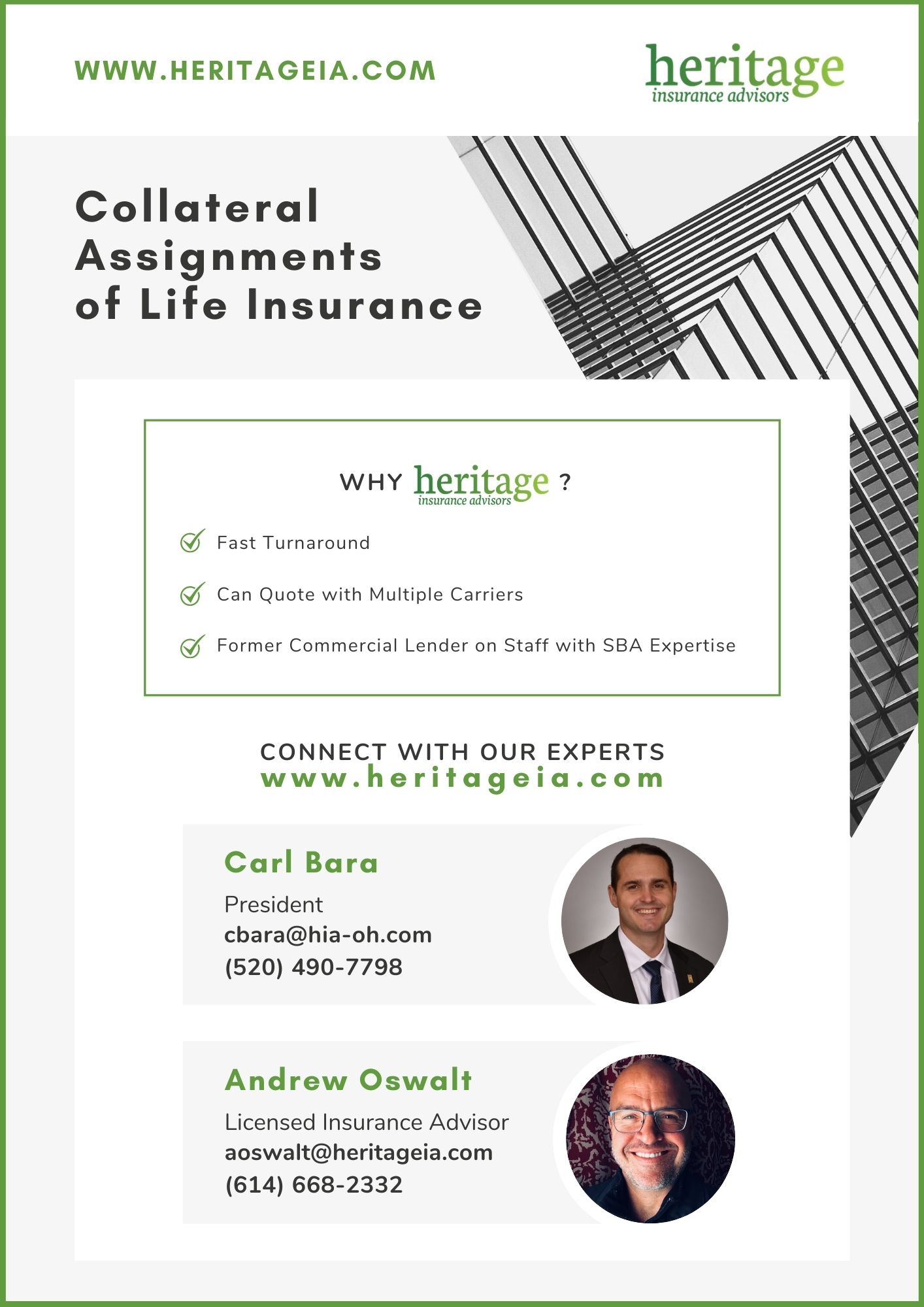

Why Heritage Insurance Advisors?

We sum it up below! Meet your experts and pass this information along to your colleagues who may benefit from a Collateral Assignment of Life Insurance.